Financial Planning in San Antonio

Financial Advising Made Simpler with the WhiteStone Way

Our firm name, WhiteStone, is drawn from a large stone obelisk built off the Isle of Portland, England in 1844 to warn sailors of dangerous reefs they could not spot from sea. Our practice was created with a similar vision in mind. WhiteStone Wealth Management Services is committed to helping grow and preserve our clients’ wealth by helping manage the unforeseen risks that can often upend one’s financial hopes and dreams.

Financial Service Areas

We develop individualized financial plans for each client, designed to provide the sustainable income they will need to enjoy everything they have dreamed about in retirement.

We provide comprehensive support for clients selling investment property and purchasing new property, with a particular focus on the Delaware Statutory Trust (DST) structure of the1031 exchange.

We focus on managing investment portfolios with a keen eye on tax-efficiency so that every client can optimize the distribution of their wealth upon transition to their heirs.

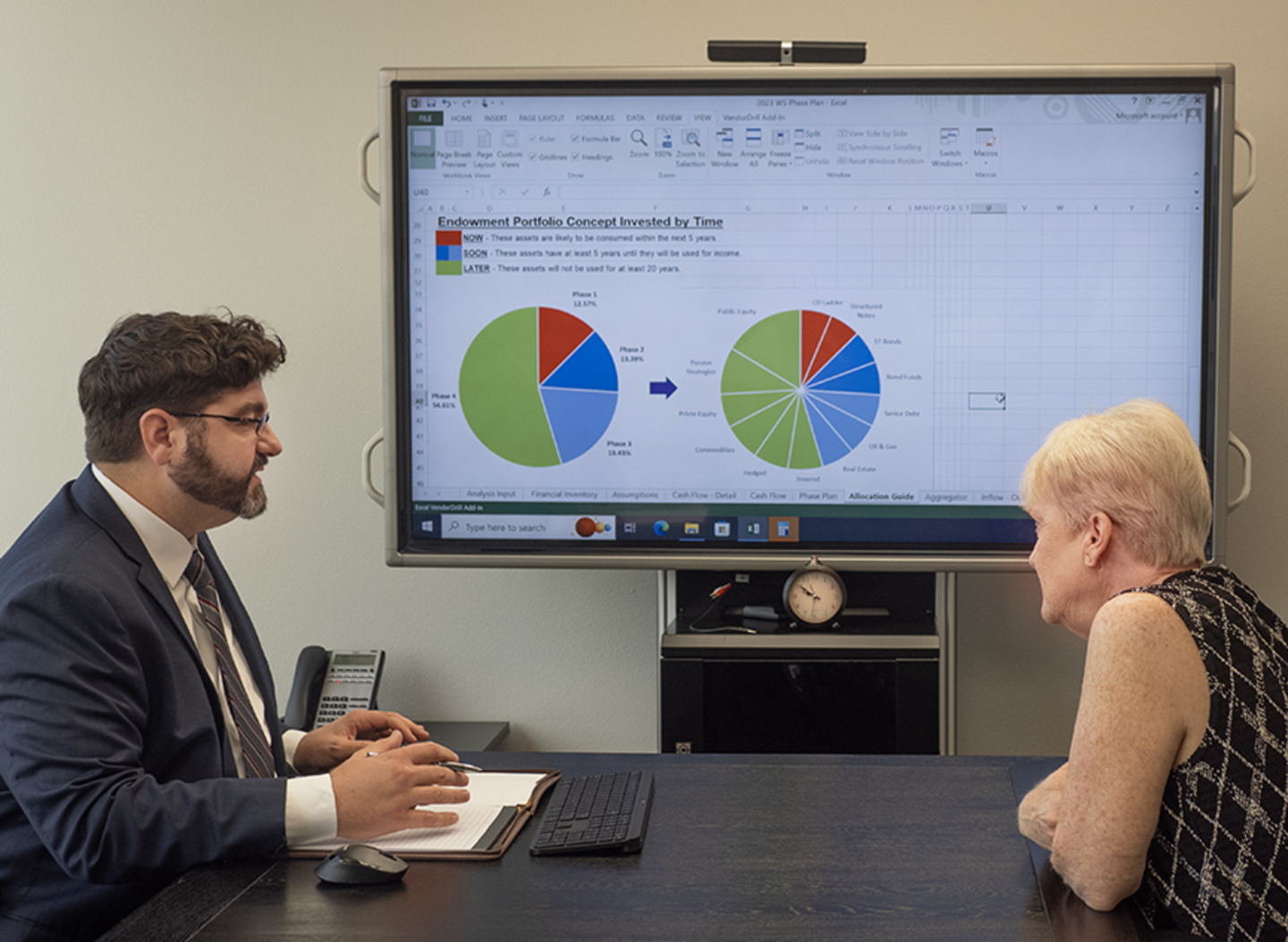

We believe investing is about more than stocks and bonds and that is why we build and manage individualized investment portfolios using a process practiced by many of the most notable endowments.

Protecting against risk and the unforeseen is a critical part of managing wealth effectively. We believe life insurance and annuities can play an important role in every financial plan.

Through our affiliation with IAS, our investment consultants provide ongoing wealth management services to individuals, families, foundations, and endowments.

Get Started With Your San Antonio Financial Planners Today

Even the best of plans could use another opinion on occasion. If you would like our team to review yours at no cost and no obligation, simply fill out this form and we will contact you very soon.

Ph: 210-341-1515

Fax: 210-341-4858

Email: info@whitestonewm.com

Hours of Operation

Monday – Friday: 8:30 AM – 4:30 PM CST